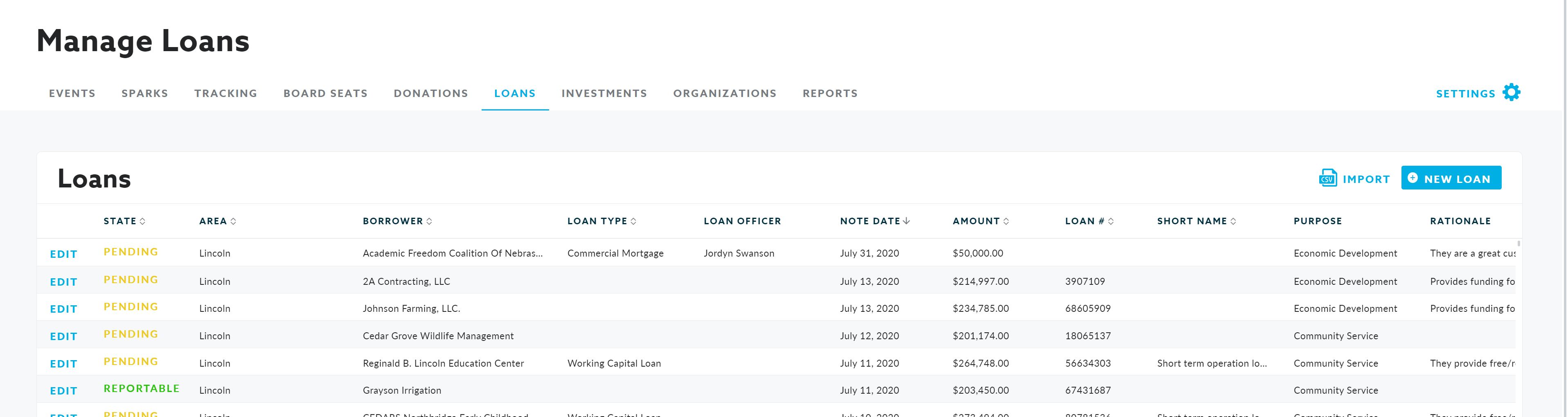

Loans

Using the Loans feature in Community Spark to view all of your loan dollars made throughout the community.

The Loans feature of Community Spark allows organizations to view all of their loan dollars made throughout the community.

Creating Loan Records

Loans may be documented in Community Spark by individually logging each loan or by importing loans from another source. See the instructions below for importing loans. To create an individual loan record:

- Navigate to the Loans feature tab under Manage and click on New Loan to the right side of the screen.

- Complete all applicable field data as available for the loan information sections including the loan borrower details.

- Hit "Save" at the bottom to save the record.

- In the event that any information needs to be added or modified, the record may be edited by locating the loan record on the Manage Loans screen and selecting Edit to the left of the listed loan.

- Once a loan record has been created it will automatically be placed into Pending status. The loan must be reviewed by the appropriate approval party to notate the approval status type. Refer to the Approving Loan Eligibility below for details.

Importing Loans

Loans can also be uploaded in bulk to Community Spark with the import feature. To bulk import loans:

- Click on the Import icon to the right side of the screen and download the import template.

- Follow the instruction on the import template and save the file as a CSV.

- Once your import file is prepared to the template specifications, you may complete the prompted import steps.

Exporting Loans

A historical export of your Loans logged within Community Spark is available by navigating to Manage and then Loans.

To bulk export Loans:

- Click on the Export icon to the right side of the screen.

- Make your selections on the Loans Export modal that opens and click Submit.

Approving Loans for Eligibility

Upon manual creation, all new loans will have their status marked as Pending. The assigned loan approver can then review the loan details to determine categorization eligibility. Status options are:

- Pending - This is the default status to notate that the loan requires approval.

- Reportable - This status is for brands to highlight specific loans they are tracking for eligibility for certain community development initiatives or CRA.

- Reviewed - This status value represents loans that have been reviewed, but are not being tracked under reportable.

In the event that loan records are imported the status may be included in the import. If the State field is left blank, it will automatically be set as Pending.